Free VAT Calculator

Use the VAT Calculator to calculate Value Added Tax and the price of your product/service including VAT.

All the latest VAT rates from countries are preconfigured for you.

Simply enter the amount and select the country for VAT

How Does the VAT Calculator work?

Famewall's Free VAT Calculator has preconfigured the latest VAT rates from countries all over the world

Here's how you can calculate Value Added Tax for your product/service for free

- Simply enter the net amount in the input field. It is the price before VAT.

- In the dropdown, select the country for which you would like to calculate VAT tax

- Some countries have different VATs for different categories. If a country happens to have multiple VAT categories then they'll be shown with options which you can choose

- Finally click "Calculate VAT" button and then the Value Added Tax is displayed along with VAT rate & total amount

Benefits of using Famewall's VAT Calculator

Famewall's VAT Calculator comes pretty much handy for your business because

- No login needed. 100% free VAT Calculator

- All the latest VAT rates from different countries are configured for you

- You don't have to worry about spending hours together to find the latest VAT rates

- You can calculate the value added tax inclusive of VAT% and net amount with just a few clicks

- VAT Rates are updated frequently to meet the changing business needs

Frequently Asked Questions

VAT is a major source of revenue for governments and is used as a means of simplifying the tax system for consumers. Hence it is levied on business transactions

Each country specifies a VAT rate based on their government policies. The vat rate is simply multipled with the net amount to calculate Value Added Tax(VAT)

Value Added Tax (VAT) is charged as a percentage of the sale price of goods and services at each stage of the production and distribution chain. The idea behind VAT is that it is a consumption tax, and is borne by the final consumer.

Businesses exceeding a specific turnover threshold (which varies based on country) must register for VAT with the relevant tax authorities. This allows them to collect and remit VAT.

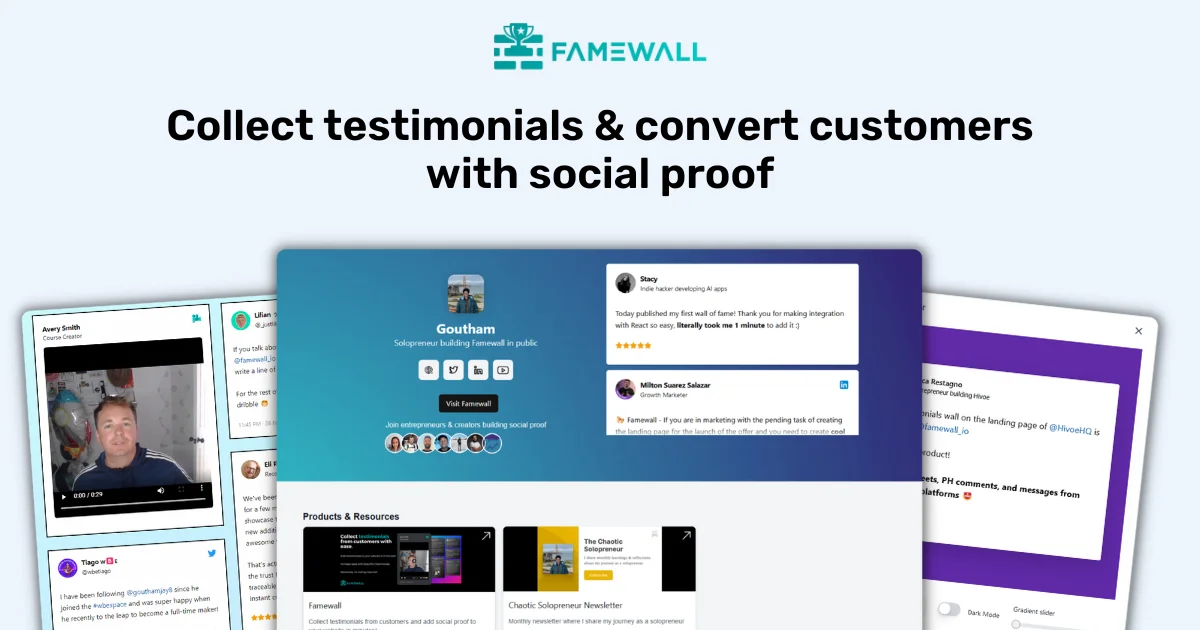

Collect & Display Testimonials with Famewall

Famewall is an affordable tool using which you can collect testimonials from customers and display them in websites, emails etc to attract more customers without any coding.

It's 100% free to try